Section 179 Tax Law Allows 100% Equipment Deduction Within Same Year

New tax reform package, the Tax Cuts and Jobs Act, offers businesses to write off 100% of the cost of modular buildings being installed in the same year.

Most of us enjoy receiving gifts, so be sure to take advantage of the tax deduction gift provided through Section 179.

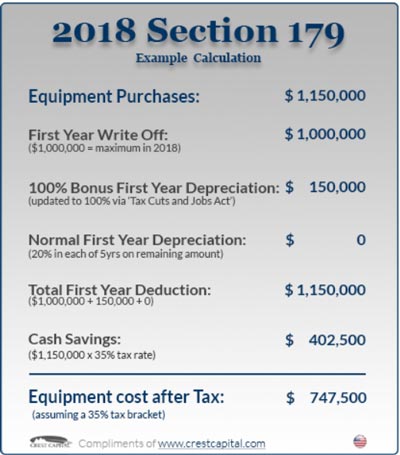

Congress passed legislation in 2018 that allows you to deduct 100% of the full cost of any Starrco modular building installed within the FIRST YEAR. If you were to spend $20,000 on a Starrco modular office system, you’d be able to write off the entire cost this year.

Congress passed legislation in 2018 that allows you to deduct 100% of the full cost of any Starrco modular building installed within the FIRST YEAR. If you were to spend $20,000 on a Starrco modular office system, you’d be able to write off the entire cost this year.

Conventional Construction vs Tangible Property

Conventional construction is depreciated over a 39 1/2 year period. But this rule doesn’t apply to Starrco modular buildings and offices.

Under the tax law, Starrco modular systems qualify as tangible personal property because, unlike permanent structures (designated as real property), modular buildings and offices can be fully dismantled, relocated and reassembled. This means you can depreciate a Starrco modular building in the same way as other capital equipment such as forklifts, rack and machinery.

Bonus Depreciation 100%

Tangible property is generally depreciated over 7 years. That is a great deal considering conventional construction is depreciated over 39 years. But, it gets even better:

As part of the Tax Cuts and Jobs Act recently signed into law, Congress has extended the bonus depreciation and increased it to 100% for 2018.

The program is designed to stimulate the economy and encourage investment in capital goods. When you reduce the amount of time it takes to claim tax depreciation on equipment expenditures, you end up having more money to invest into your business’ future success.

Fast Installation Video

Watch how fast and efficient the entire modular office installation process really is.

In addition to pre-engineered modular offices, we offer cleanroom wall systems, floor-to-ceiling interior wall partitions, and safety guard rail systems for collision protection.

Give us a call at 800-442-3061 to speak to one of our specialists now. We’d be happy to show you how the Section 179 Deduction can apply to your modular building project.

Give us a call at 800-442-3061 to speak to one of our specialists now. We’d be happy to show you how the Section 179 Deduction can apply to your modular building project.

Find the Right Solution

How can we help you solve your challenges? Reach out and someone will be in touch soon for more details.

Other Topics

Related Stories

The loading dock is essential to any business. It should operate safely, efficiently, and dependably, as it’s a vital part…

Aerosol storage cages play a crucial role in ensuring safety, compliance, and efficient management of potentially hazardous materials. These cans…

Over the past decade, the warehousing and distribution center sector has grown substantially, with a workforce exceeding 1.9 million individuals…